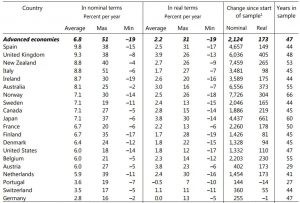

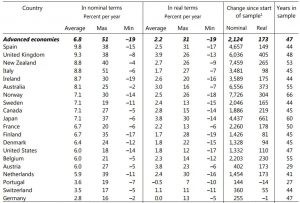

Here is a wild set of statistics from the Bank of International Settlements on growth in house prices around the world.

It shows Australian house prices are up a world-leading 6,556% over the past 55 years, or 373% when adjusted for inflation. That smashes the average increase of a 2,124% uplift in house prices (173% in real terms) across advanced economies over a similar period.

Source: Bank of International Settlements

Australia’s record is not quite as impressive as New Zealand’s, with 7,459% growth over 53 years.

UBS economists George Tharenou and Carlos Cacho said in a note to clients today that Australian house prices “astonishingly super-boomed” in that period, with “a world record for the longest continuous ‘upswing’.

“Growth averaged 8.1% y/y in that period, with the level of prices doubling every 9 years. While this was ‘only’ the 6th fastest among advanced economies, since

2000, the cumulative price rise of ~150% in Australia (& NZ) was actually the largest,” they wrote.

“This price boom was driven since 1990 by collapsing interest rates, seeing household debt-income nearly triple to ~195% now, but household wealth-income lifted even

more to ~742%, both the ~highest in the world,” Tharenou and Cacho said. “This supported consumption via the ‘household wealth effect’, as the household savings rate ~halved in recent years to a post-GFC low of [less than] 5%.”

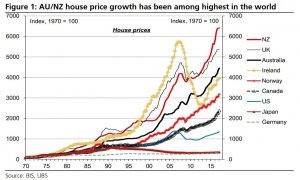

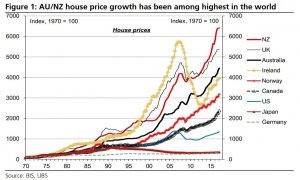

They share this chart, which tracks house price appreciation — and the spectacular collapse of the Irish property market through the GFC — in select countries around the world since 1970.

Time will tell if anything like the horror of the Irish property market implosion will ever be repeated in the modern era.

- Written by Paul Clogan, publisher and editor-in-chief at Business Insider Australia.